Nvidia at the Summit: Can the AI King Meet the Sky-High Expectations of Wall Street?

Aug 26, 2025 |

👀 95 views |

💬 0 comments

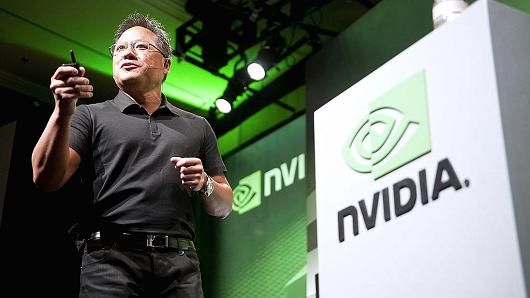

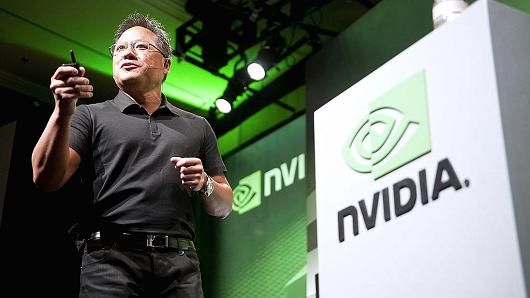

Two years ago, the launch of ChatGPT ignited the artificial intelligence boom, catapulting Nvidia from a respected graphics card company into the undisputed king of the AI revolution. Today, as the tech titan prepares to deliver its latest quarterly earnings, it stands as the world's most valuable company, a $4.3 trillion behemoth facing a new and formidable challenge: the crushing weight of impossible expectations.

As Nvidia marks the second anniversary of the AI gold rush this month, its stock has delivered a staggering 1,400% return since the movement began. It has become the bellwether for not just the tech sector, but the entire market, its fortunes inextricably linked to the broader economic narrative. But as the company readies its Q2 fiscal 2026 report, the question on every investor's mind is no longer "How high can it go?" but "Can it possibly go any higher?"

The pressure is immense. After a series of quarters with jaw-dropping, triple-digit revenue growth, the pace is naturally beginning to slow. Wall Street analysts, who have overwhelmingly maintained "Buy" ratings and have been consistently raising their price targets, now forecast revenue growth of around 53%—a spectacular figure for any other company, but a notable deceleration for Nvidia.

"Perfection is all Wall Street will settle for at this point," one analyst noted. "Even the slightest hiccup, a minor miss on revenue or a cautious word on guidance, could trigger a significant market sell-off."

The challenges are mounting:

The Law of Large Numbers: It is simply harder to maintain explosive growth when your revenue is already in the tens of billions per quarter.

Rising Competition: While Nvidia's leadership remains unchallenged for now, competitors like AMD and even in-house chip designs from its largest customers (like Google, Amazon, and Meta) are chipping away at the edges.

Geopolitical Headwinds: Navigating U.S. export controls to China remains a complex and delicate dance, creating uncertainty around a massive potential market.

Valuation Concerns: With a valuation that has eclipsed the entire stock markets of most countries, any sign of slowing AI demand could lead investors to question if the stock has gotten too far ahead of itself.

Despite these pressures, the bulls remain firmly in charge. The demand for AI infrastructure is not slowing down. Nvidia's biggest customers have collectively budgeted over $320 billion for AI-related capital expenditures this year alone, and Nvidia is capturing the lion's share of that spending.

The upcoming earnings report on August 27th will be a critical moment of truth. Investors will be parsing CEO Jensen Huang's every word for signals about demand for the next-generation "Blackwell" and "Rubin" chips and for any signs that the insatiable appetite for AI is beginning to cool.

Two years into the boom, Nvidia is no longer a scrappy innovator; it is the reigning monarch of the tech world. But as history has shown, the view from the top is precarious, and the market is unforgiving of any king who shows the slightest sign of a faltering step.

🧠 Related Posts

💬 Leave a Comment